COVID Wage Supplement

WAGE SUPPLEMENT FINAL EXTENSION UNTIL MAY 2022

Malta Enterprise would like to announce that the Wage Supplement to employees whose companies have been impacted by COVID-19 will be retained till the end of May 2022. The format and value of disbursement will follow the system currently in place. The situation will remain under review.

Press Conference on the 28th April 2022: https://fb.watch/cLBcafpRNT/

Wage Supplement – August – December 2021

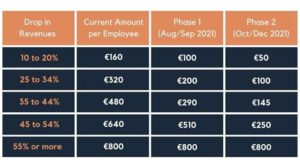

A new Tapering system was announced that shall be utilized for the disbursement of the Wage Supplement Scheme from August to December 2021.

Worst-hit companies—with an impact of 55% of more (2019 on 2020) – will continue to receive the wage supplement in full until the end of year. Therefore, they will experience no change.

Tapering for the other categories will take place in two phases:

Phase 1: August to September

Phase 2: October to December

However, starting from August, the four other categories of business will all start to receive less state support as outlined below:

2021 Schemes

Click here for Apr – Jul 2021

Click here for Jan – Feb 2021