Rent & Electricity Refund Scheme

Top-up of Rent Support Scheme

- Rent scheme will be extended by a further 50% over and above the rent assistance provided for 2020

- Applicable to those undertakings closed in March 2021

- New applications for those approved under the Wage Supplement Scheme in 2021 will be accepted

Applicants requesting assistance under the Rent Scheme 2021 should submit one of the following as proof of payment:

Either: A signed receipt from the Landlord stating that rent for any month in 2021 has been paid by Tenant as per active rental agreement;

Or: A bank statement showing that payment for any month in 2021, with a description clearly relating to lease, has been transferred from Tenant’s bank account to Landlord as per active rental agreement.

If a cheque payment has been made, a cheque image must also be submitted with bank statement as proof that cheque was made in Landlord’s name.

Deadline extended to the 13th August 2021

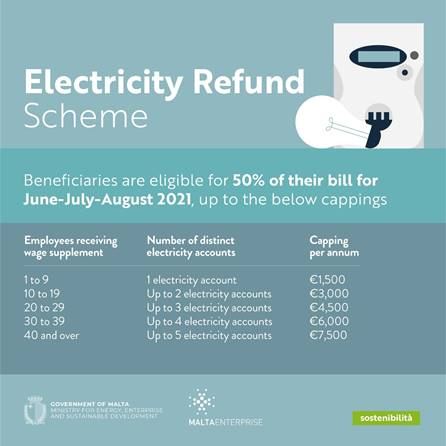

Top-up of Electricity Support Scheme

- The Electricity Support Scheme will be re-issued, covering June, July and August 2021

- Scheme will be open to businesses closed in March 2021

- The subsidy will cover 50% of the total electricity bill

More details at: https://covid19.maltaenterprise.com/wp-content/uploads/2021/06/RENT-ELE-REFUND-SCHEME.pdf